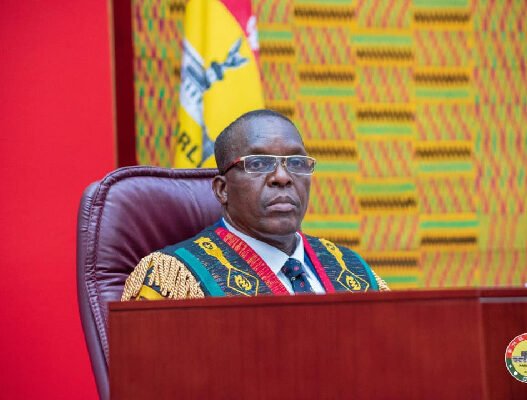

On Friday, October 11, 2024, Daasebre Akuamoah Agyapong II, the Omanhene of the Kwahu Traditional Area and Chairman of the Agricultural Development Bank (ADB) Board of Directors, resigned after being implicated in a serious extortion scandal. His resignation followed allegations made by a Ghanaian businessman, Collins Darkwa, who accused the chief of soliciting bribes to approve a substantial loan.

This incident has cast a shadow over both Daasebre Akuamoah Agyapong II and ADB, raising concerns about leadership and governance in the banking sector.

Allegations and the Scandal

The scandal erupted when Collins Darkwa filed a formal petition to the Office of the President, accusing the ADB Board Chairman of demanding large sums of money to facilitate the approval of a GH¢12 million loan. Darkwa claimed that the Omanhene initially requested GH¢50,000, followed by subsequent payments totaling GH¢2,408,000. These payments were made under duress, as Darkwa needed the loan to meet supply chain obligations for a cashew contract.

Despite making these payments, Darkwa alleged that Daasebre Akuamoah Agyapong II did not fulfill his end of the deal. Instead, the chief reportedly used his influential position as ADB Board Chairman to coerce Darkwa into making further payments, threatening to block his business if he refused. These allegations of bribery and extortion, if proven true, highlight the abuse of power and raise questions about accountability at the highest levels of corporate leadership.

Resignation and Institutional Response

Following an emergency board meeting, Daasebre Akuamoah Agyapong II resigned from his position as Chairman of the ADB Board to allow for a full investigation. His resignation, while a significant development, was crucial in protecting the bank’s reputation and ensuring transparency in the ongoing inquiry. The Bank of Ghana (BoG) had also issued a directive calling for his resignation, citing Section 103 (2)(d) of the Banks and Specialised Deposit-Taking Institutions Act, 2016 (Act 930), which mandates that individuals in compromised positions step down to maintain public trust and institutional integrity.

The BoG’s decisive action demonstrates the regulatory body’s commitment to maintaining governance standards within the financial sector. It also reinforces the importance of ethical leadership, especially in institutions that play a critical role in Ghana’s economic development, such as ADB.

Daasebre’s Rise to Leadership at ADB

Daasebre Akuamoah Agyapong II’s appointment as ADB Board Chairman in 2021 marked the beginning of a new chapter for the bank. He replaced Alex Bernasko, taking on the responsibility of steering the bank towards its mission of supporting agribusiness and rural development. Under his leadership, ADB sought to leverage agribusiness as a driver of economic growth, wealth creation, and poverty reduction in Ghana. As the Omanhene of the Kwahu Traditional Area, Daasebre was seen as a prominent figure capable of bridging traditional leadership with modern corporate governance.

Daasebre’s qualifications made him a suitable candidate for the role. He holds a Bachelor’s degree in Business Administration (Accounting) from the University of Ghana and a Master’s degree in Finance and Investment Banking from Lincoln University in the United States. Before ascending to the Kwahu throne in 2017 at the age of 34, he gained experience working at KPMG and Goldfields Ghana Ltd in various finance and consultancy roles. His leadership journey was widely celebrated as a blend of traditional authority and modern business acumen.

The Broader Impact on ADB and the Financial Sector

The resignation of Daasebre Akuamoah Agyapong II highlights the delicate balance between leadership, ethics, and public trust. As a key institution in Ghana’s agricultural development, ADB plays a vital role in providing financial services to one of the country’s most important sectors. Any scandal involving its leadership risks damaging the bank’s credibility and undermining its ability to serve its mission effectively.

Moreover, the scandal raises broader questions about corporate governance in Ghana’s banking sector. The Bank of Ghana’s swift response demonstrates a zero-tolerance policy towards corruption and unethical practices, sending a strong message to other financial institutions. For ADB, the priority will now be restoring confidence among its stakeholders, including farmers, businesses, and the public.

Conclusion

As the investigation into the extortion allegations against Daasebre Akuamoah Agyapong II unfolds, this scandal serves as a stark reminder of the importance of integrity in leadership positions. The chief’s resignation, though necessary, underscores the consequences of failing to uphold ethical standards in the corporate world. The outcome of this case will likely set a precedent for how future allegations of corruption are handled in Ghana’s financial sector, with long-term implications for governance and accountability.