As Ghana continues its push for economic growth, corporate responsibility plays an increasingly important role in fostering national development. One notable example of this commitment is Star Oil, a wholly Ghanaian-owned Oil Marketing Company (OMC), which made significant contributions in 2024 through compliance with tax obligations, infrastructure expansion, and job creation. However, this example also provides an opportunity to reflect on the broader landscape of corporate responsibility, tax compliance, and the consequences of evasion.

Star Oil’s Impact in 2024

Star Oil’s achievements in 2024 are a testament to its dedication to both business excellence and national development:

Tax Compliance

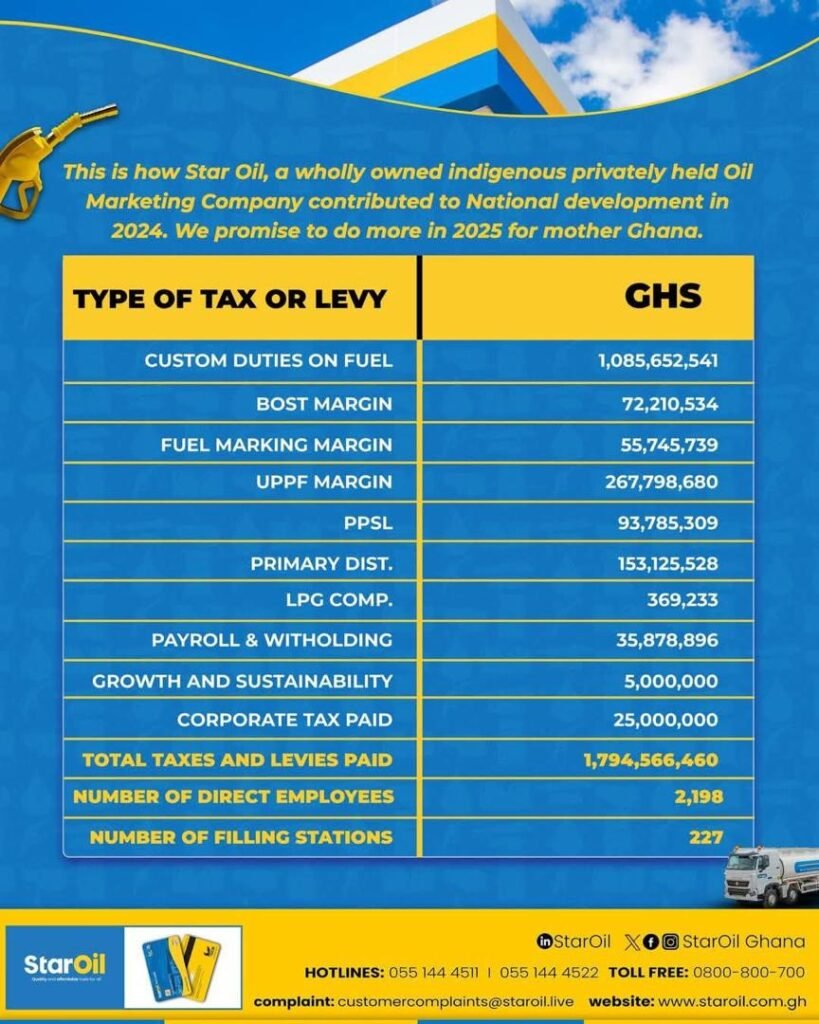

Star Oil paid over GHS 1.79 billion in taxes and levies, covering a broad spectrum of national fiscal obligations:

| Tax or Levy | Amount Paid (GHS) |

|---|---|

| Custom Duties on Fuel | 1,085,652,541 |

| Unified Petroleum Price Fund (UPPF) Margin | 267,798,680 |

| Corporate Tax | 25,000,000 |

| Payroll & Withholding Taxes | 35,878,896 |

These contributions financed critical national projects and government services, demonstrating the impact of tax compliance on sustainable development.

Economic Contributions

- Direct Employment: Star Oil directly employed 2,198 Ghanaians, supporting livelihoods and contributing to economic stability.

- Infrastructure Development: With 227 filling stations, Star Oil ensured fuel availability across the country, including underserved areas, facilitating commerce and mobility.

Tax Evasion: A National Challenge

While companies like Star Oil set an example, others in Ghana’s petroleum and broader corporate sector evade taxes, depriving the nation of vital resources. For instance:

- Revenue Losses: According to the Ghana Revenue Authority (GRA), Ghana loses billions of cedis annually due to tax evasion. The petroleum sector, despite being lucrative, is often implicated in these losses through practices such as underreporting sales, falsifying import documents, or siphoning profits offshore.

- Economic Impact: Tax evasion erodes public trust, reduces government revenue, and compromises essential services like healthcare, education, and infrastructure.

- Inequality: Compliant businesses face unfair competition from tax evaders, distorting market dynamics and discouraging responsible corporate behavior.

Corporate Responsibility and the Bigger Picture

Comparisons to Industry Giants

Some multinational corporations and local giants operating in Ghana have been accused of evading taxes. A 2022 study by Tax Justice Network highlighted how tax avoidance schemes by large corporations cost developing countries like Ghana billions of dollars annually.

- Underreporting Revenue: In 2021, investigations into some OMCs revealed discrepancies in fuel sales reporting, resulting in significant revenue losses for the state.

- Profit Shifting: Certain foreign-owned companies in Ghana were implicated in transferring profits to low-tax jurisdictions to evade local taxes.

Star Oil’s exemplary tax compliance stands in stark contrast to such practices, showing that indigenous companies can lead by example in supporting national development.

Educating on Tax Compliance

Tax compliance is not merely a legal requirement; it is a moral obligation. Businesses must recognize their role in nation-building and the broader economic benefits of paying taxes:

- Enhanced Infrastructure: Taxes fund roads, ports, and energy projects, which, in turn, benefit businesses by improving logistics and operations.

- Social Stability: Revenue from taxes supports health, education, and social services, contributing to a more stable workforce and consumer base.

- Reputation and Goodwill: Tax-compliant companies build trust with customers, investors, and regulators, positioning themselves as ethical leaders in their industries.

Recommendations for Strengthening Tax Compliance

To ensure equitable contributions across the corporate sector, the following steps are essential:

- Enhanced Monitoring: The GRA should strengthen its audit mechanisms, leveraging technology to detect underreporting and discrepancies.

- Incentivizing Compliance: Offer tax breaks or recognition programs for companies with consistent compliance records, encouraging others to follow suit.

- Penalizing Evasion: Enforce strict penalties for tax evasion to deter malpractice and ensure accountability.

Conclusion: A Call to Action

Star Oil’s contributions in 2024 underscore the critical role of corporate responsibility in national development. While the company serves as a shining example, the issue of tax evasion among other industry players remains a significant challenge. Ghana’s economic future depends on collective action—government enforcement, corporate accountability, and public awareness—to ensure that every entity pays its fair share.

As Star Oil pledges to do even more in 2025, it also challenges others to step up. The path forward requires a collaborative effort, where responsible businesses like Star Oil partner with the government and civil society to build a stronger, more sustainable Ghana.